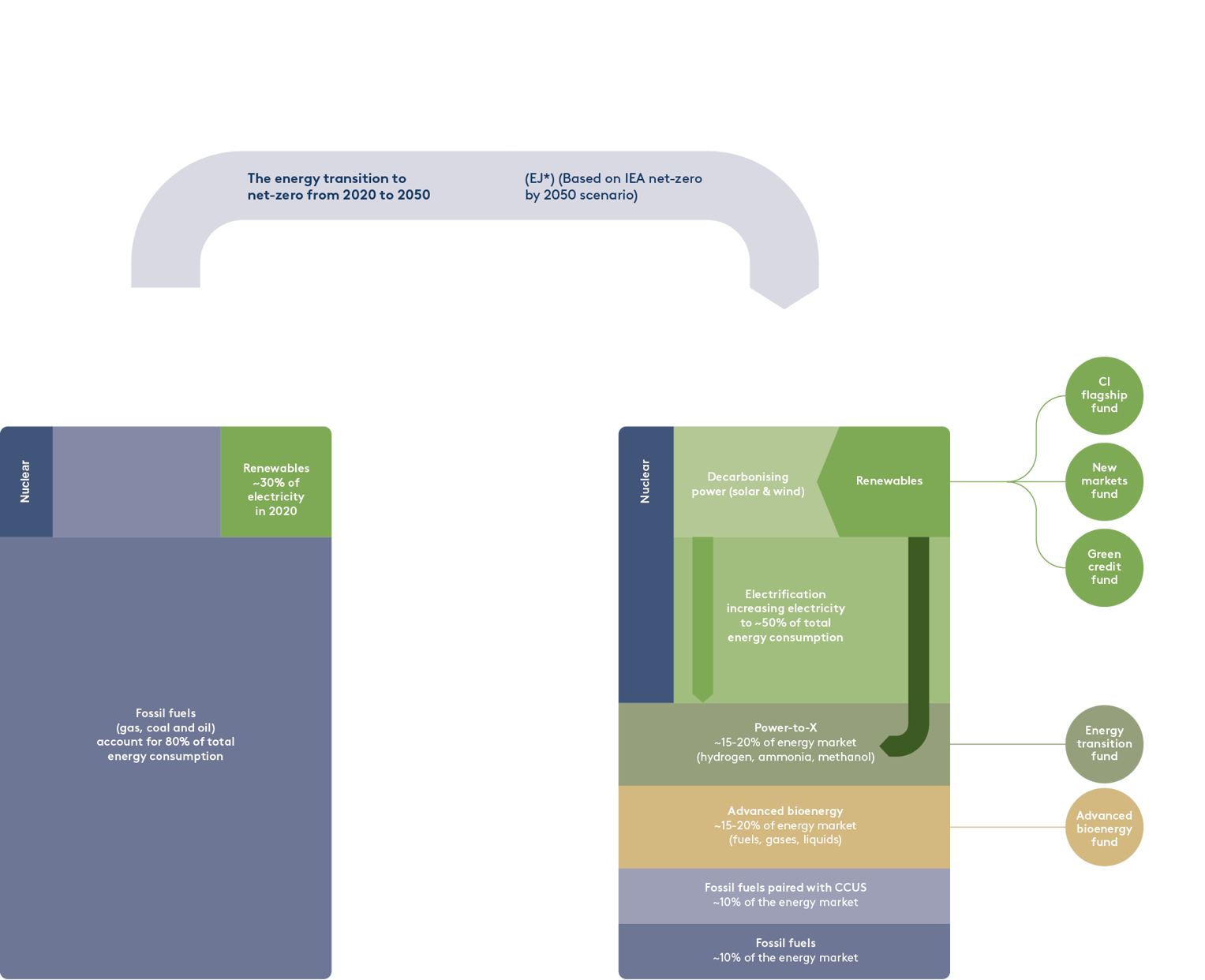

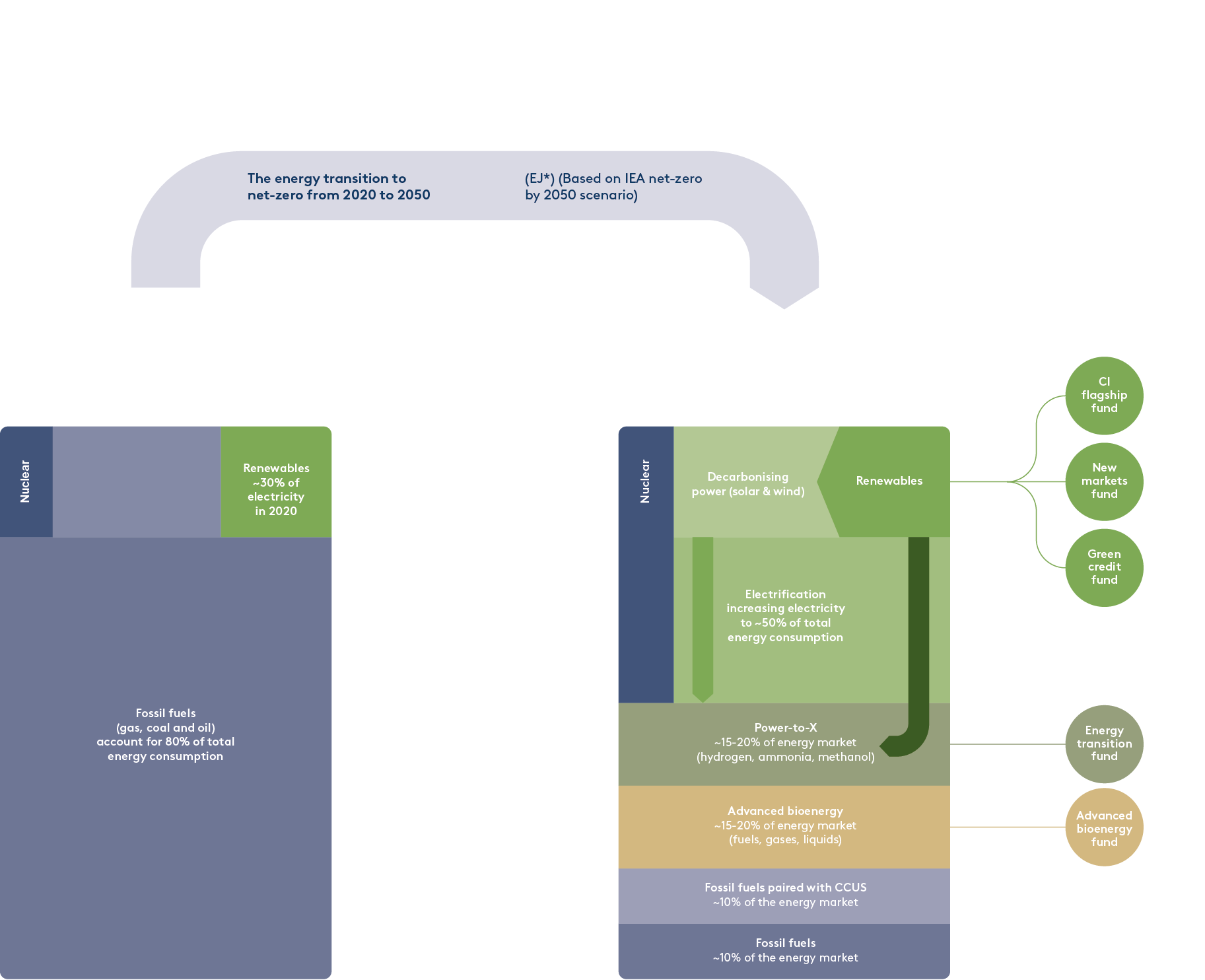

Up until recently, the green energy transition was driven by pledges by governments around the globe to achieve net-zero. All major economies committed to ambitious emissions reduction targets, including investments in clean energy infrastructure. Governments, as well as the private sector, pledged to accelerate the transition to net zero greenhouse gas emissions by 2050.

In recent years, this development was further accelerated by an immediate need to secure predictable energy supply at affordable prices. Renewables are also, in many cases and markets, cost-competitive with fossil fuels. Consequently, the opportunities to scale-up renewable infrastructure are historically plentiful and demand for renewables has increased subsequently.