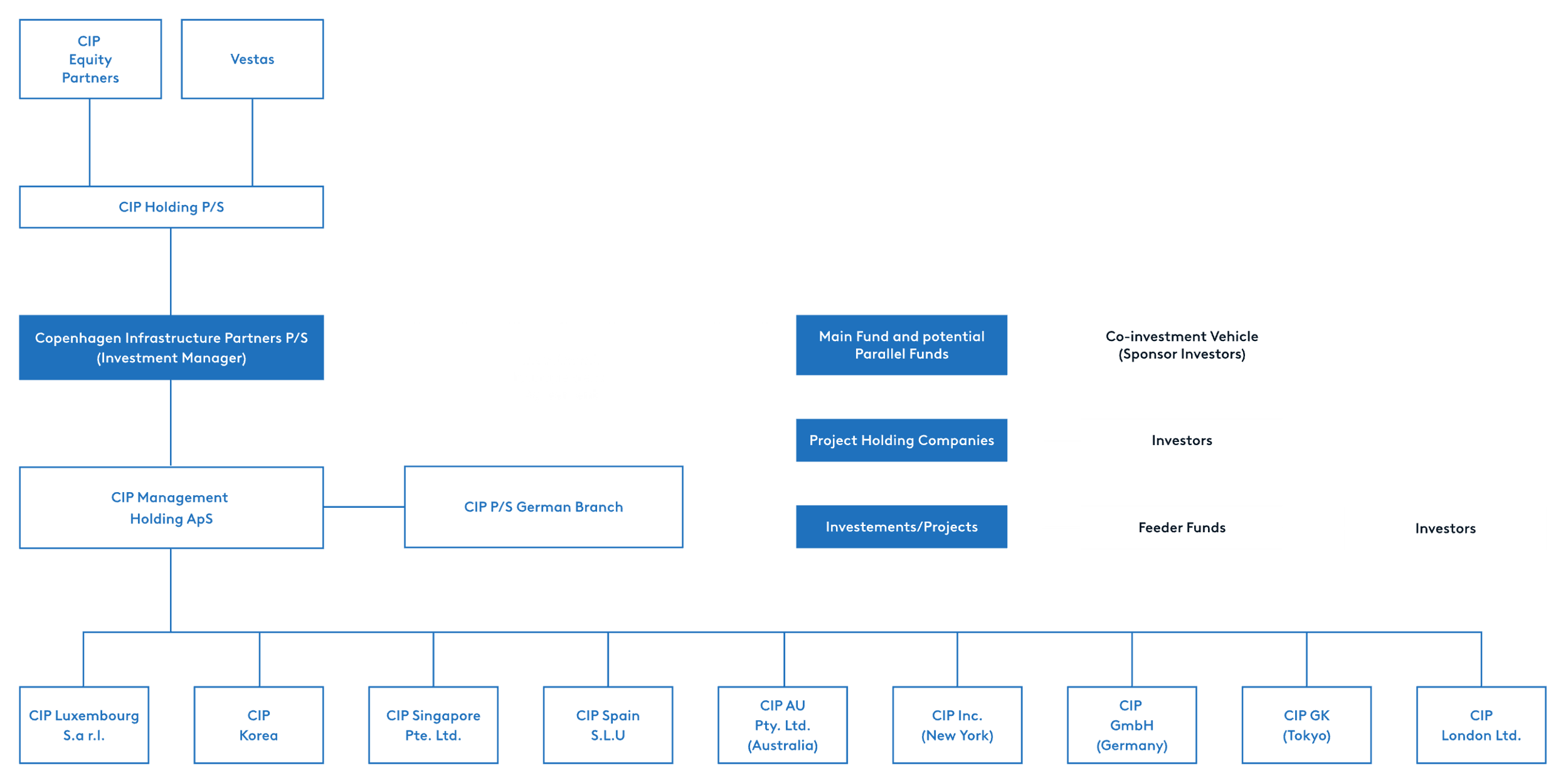

Our corporate structure comprises three management companies: Copenhagen Infrastructure Partners I K/S (CIP I K/S), Copenhagen Infrastructure Partners II P/S (CIP II P/S) and the primary management company, Copenhagen Infrastructure Partners P/S (CIP P/S). The structure for each of the management companies is common among private equity fund managers.

The model below shows the structure for CIP P/S *. A separate structure exists for funds managed by CIP K/S and CIP II P/S. But no new activities are expected in CIP I K/S or CIP II P/S and all future Copenhagen Infrastructure funds will expectedly be managed exclusively by CIP P/S under CIP’s current licence with the Danish Financial Supervisory Authority.