CIP is a fund management company and formal signatory to the UN Principles for Responsible Investment (‘UN PRI’) and the United Nations Global Compact (‘UNGC’). Our approach to sustainability is founded on a strong and consistent link between high environmental, social and governance (ESG) standards and value creation and protection. CIP Fund investments are expected to positively impact the environment, avoid substantial GHG emissions, provide critical societal infrastructure, and aid high-quality job creation.

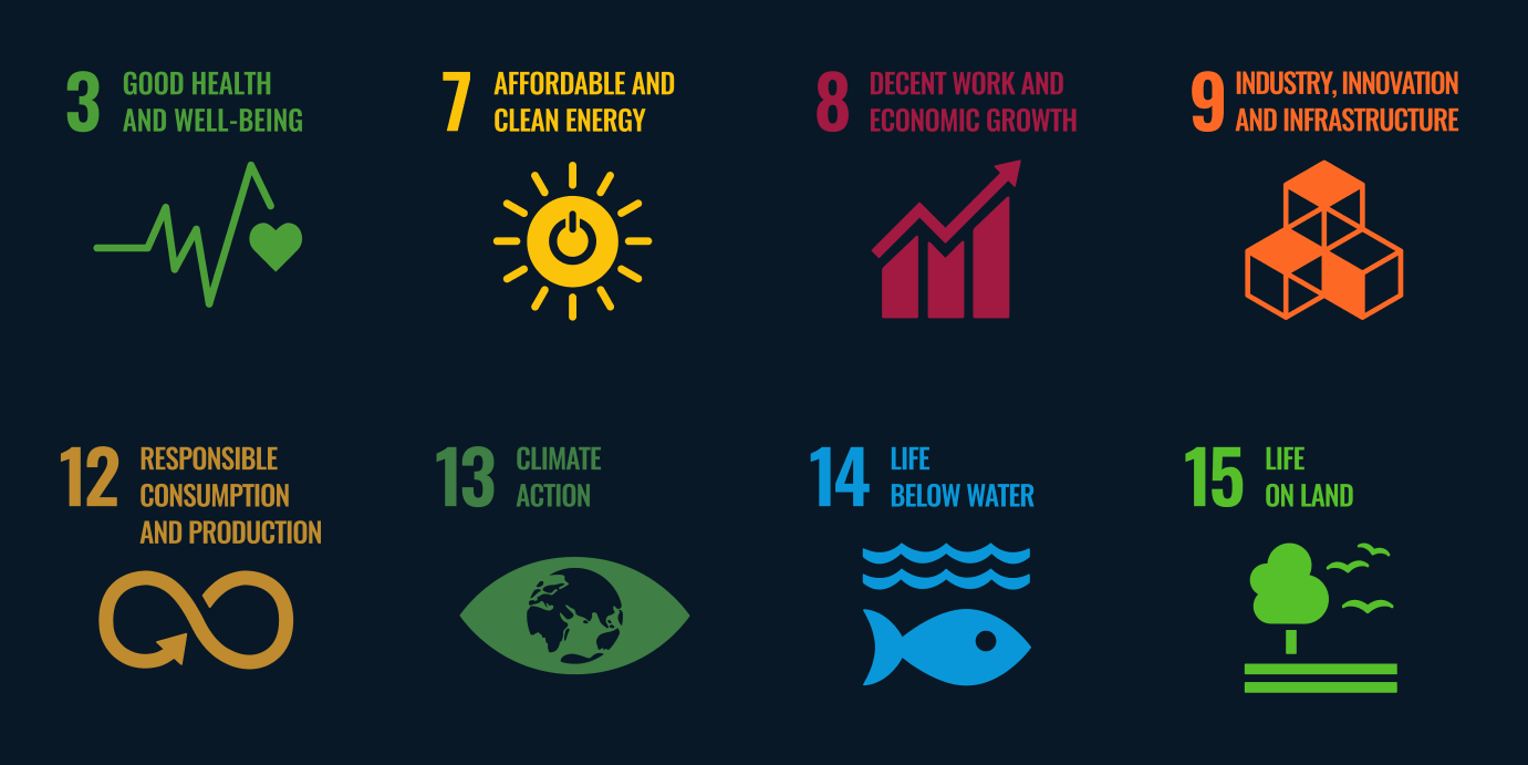

CIP’s objective is to create value for its investors, and high ESG standards are a prerequisite to maximising this value. CIP integrates ESG throughout the investment process and implements ESG at the project level. CIP uses the UN’s Sustainable Development Goals (SDGs) framework to measure the impact of our funds under management. Currently, the following key targets guide our efforts. For further information on CIP’s 2023 contribution to the SDGs, please refer to p. 60 of CIP’s 2023 ESG Report.

In 2021, the EU introduced the EU Sustainable Finance Disclosure Regulation (SFDR), which aims to increase transparency on sustainability risks and impacts by ensuring that fund managers consider and disclose sustainability risks in their investment processes. It forms part of the EU’s ’Green Deal’, aiming to channel investment towards sustainable activities and assist member states in reaching climate objectives. Under the SFDR, funds are categorised based on their contribution to these sustainable activities. The most sustainable category is an Article 9, a so-called Dark Green fund.

CIP provides investors with direct access to investments in Article 9 Dark Green funds – Fund CI V is expected to be one of the largest Dark Green funds globally.

We adhere to several international ESG standards, industry initiatives reporting and climate disclosures.

CIP is a signatory or supporter of:

CIP provides reporting and disclosures on:

We deliver a significant and meaningful contribution to the green transition, and CIP Fund investments promote positive impact. In 2023, our combined projects contributed to an approximate 12.9 million tonnes of expected GHG emissions avoided annually and 13.2 million expected equivalent households to be powered.

We will continue to proactively address ESG issues, expand ESG efforts into the supply chain, and increase sustainability risks and impact transparency.

By 2030, CIP’s investments have the potential to supply the planet with approximately 150GW clean energy, keep 70m households sustainable-powered, and reduce global emissions by 150 megatons of CO2.