A new large-scale project in Australia, with wind and solar power, will convert renewable electricity into hydrogen and ammonia for export purposes. The project uses Power-to-X technology. Because ammonia can be transported by vessel, it offers a unique opportunity to connect production and consumption and help countries to meet their climate goals.

In Western Australia, some 600 kilometres north of Perth, Copenhagen Infrastructure Partners has secured a large tract of land with outstanding potential for renewable energy generation.

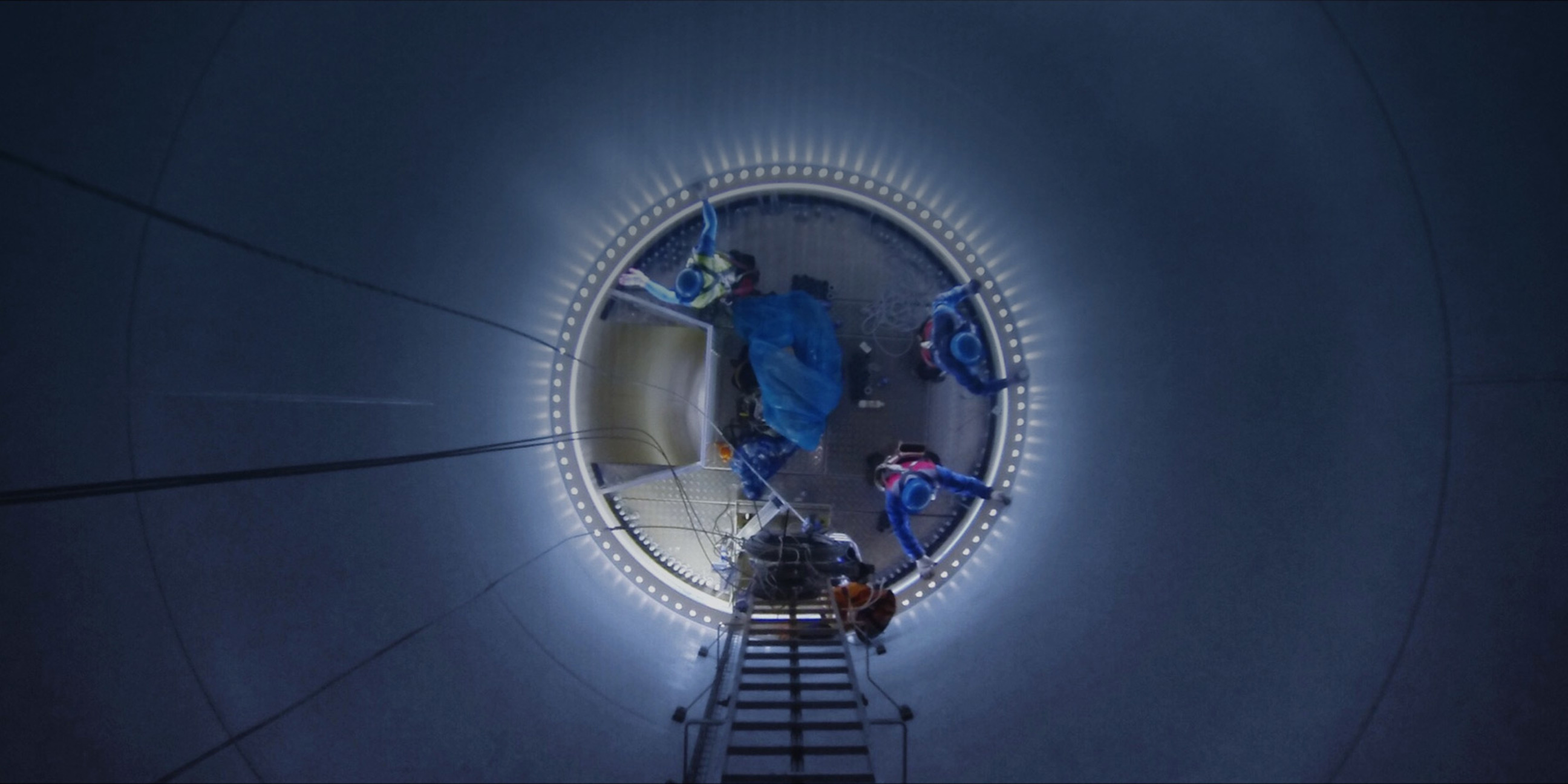

The 126,000-hectare Murchison plot can host a substantial, large-scale renewable energy project with wind and solar power and produc- tion of 6GW, with 3GW of electrolyser capacity, enabling the conversion of electricity into hydrogen gas which can be transported and exported.

It has some of the best wind and solar combi- nation on the planet – really strong winds and really strong sun. These complement each other as typically the wind is strong when the sun isn’t shining, and vice versa.

The Murchison project, partnered with Hydrogen Renewables Australia Pty Ltd, was announced in November 2020. Once operational, it will convert hydrogen into green ammonia to be exported to countries such as Japan, South Korea and Taiwan with dense populations and limited land for renewable energy projects. The green ammonia produced by the Murchison plant has the potential to reduce annual emissions by up to 4.4 million tons of CO2. A final investment decision is expected in 2025.

Murchison is a key project in the CI Energy Transition Fund I (CI ETF I), reaching final close at the €3 billion hard cap. The fund invests in next-generation renewable energy infrastructure, including industrial-scale Power-to-X (PtX) projects, which enable decarbonisation of sectors such as transport and chemicals, where historically there have been no renewable alternatives at scale. This development is driven by the cost reductions in renewable electricity and the fact that renewable electricity is now the cheapest form of electricity. As a result, it is now meaningful to convert low-cost renewable energy into hydrogen gas through electrolysis.

The fund will primarily focus on greenfield projects in western Europe, North America, Australia and developed Asian countries. As well as PtX, it may also invest in carbon capture and utilisation/storage and other technologies, applications and solutions for decarbonisation. CI ETF I has established an attractive portfolio of PtX. Its pipeline has a total capacity of more than 20GW with integrated and export projects and exposure to different offtake markets.

Solutions like PtX are essential for countries and industries to take the next big leap in the decarbonisation and reach their commitments under the Paris Agreement. Large offtake markets for green hydrogen and ammonia are taking off. The existing market and infrastructure enable the deployment of green ammonia in fertiliser and chemicals markets. Over the coming years, technological advances will enable the use of green hydrogen and ammonia for steel, power generation, heavy road transport and shipping.

PtX technology combined with low-cost renewable electricity enables the size and scope of the Murchison project. Now that the power grid no longer confines renewable energy, governments can monetise resources which are not close to a power line or an urban centre. Many of the globe’s best renewable resources - high wind and intense sun - are found in remote locations. This resource is now available to harness and adopt into the energy mix.

It also allows for renewable energy to be stored and transported in the form of compressed gas for fuel and feedstocks, which is significantly larger than the power market. Consequently, in markets where governments have previously been concerned about a too rapid build-out of renewable energy and adverse impacts on market prices, this should no longer be a concern. The main uncertainty now for PtX projects is how quickly the offtake market for exports will develop.

We believe this industry will look a lot like liquified natural gas, where you sell your product on long-term contracts to de-risk it. The question for us is, when will buyers be ready to sign up for 15-20-year offtake contracts? I am confident it will happen. It’s just a matter of when.

Australia is a very attractive country for investment, given its stability and a high degree of transparency. CIP is also looking at other similar markets with a combination of wind and solar and a good investment environment.

Meanwhile, Murchison is progressing well. There is an agreement in principle to acquire the land, and a feasibility study with a technology provider has been completed. CIP has established an office in Perth with a strong team.

Now we can take areas with wonderful natural resources and connect them to markets, as it’s a molecule, not an electron. We have a green product that can be imported in large volumes, and because this is a mature technology, it’s scalable. So it’s a great opportunity for both the producing and consuming countries.

Across the world CIP is engaged in green energy and infrastructure projects. Here are a few of them.