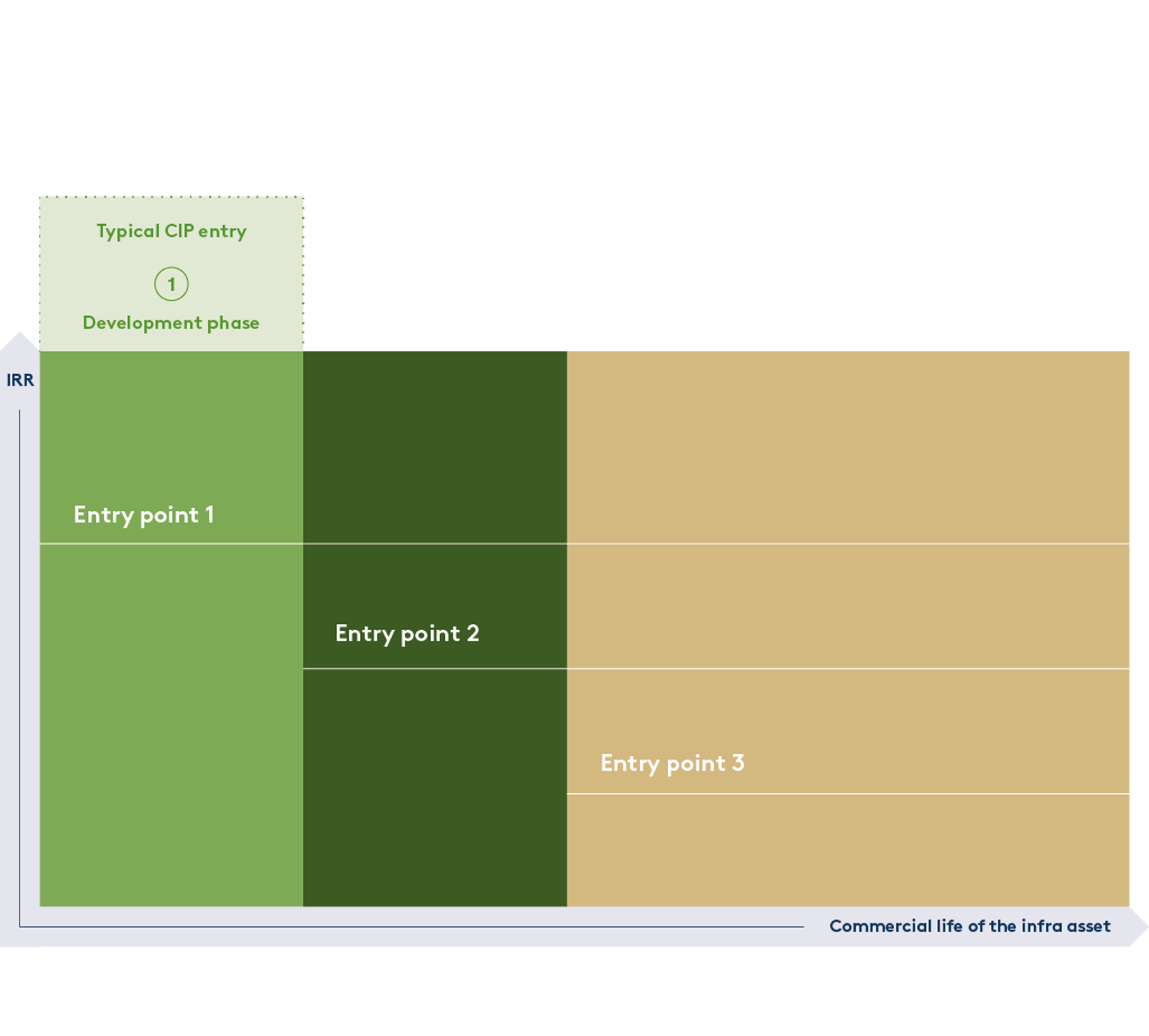

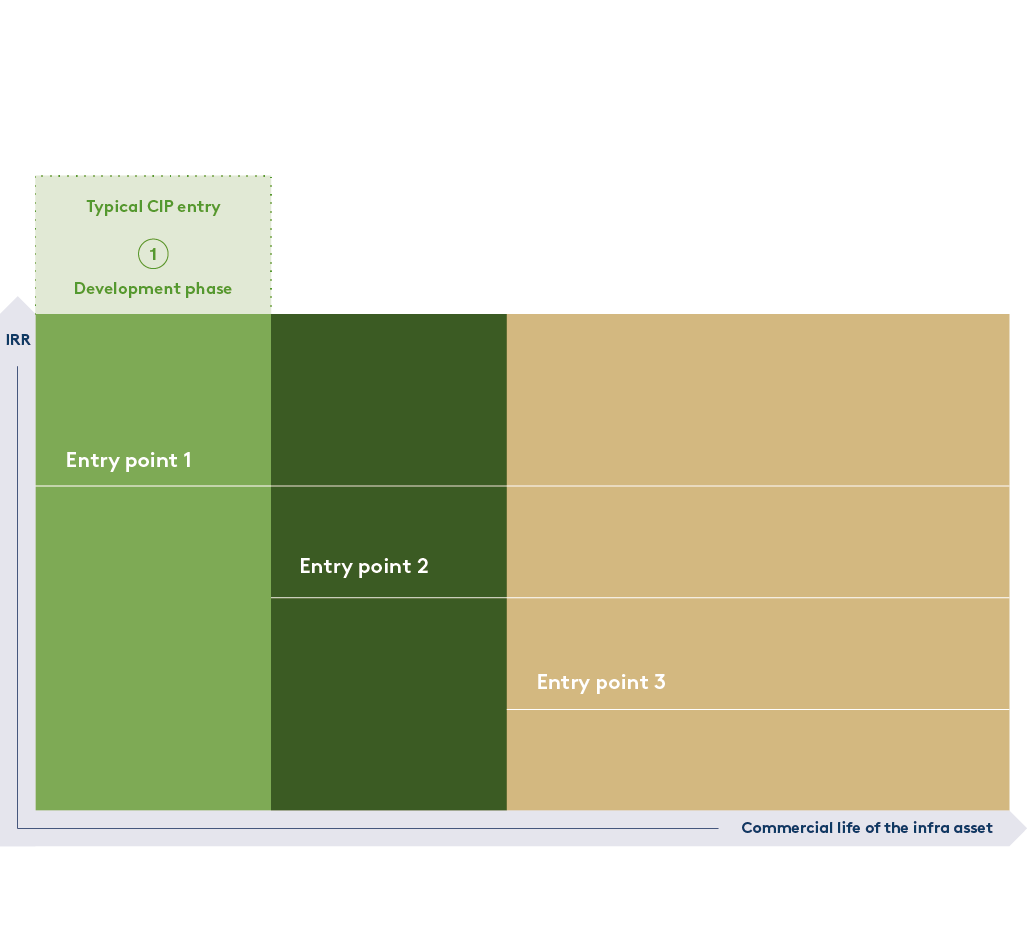

We create value for investors by capturing the greenfield premium, and by having a dedicated focus on de-risking as well as leveraging a global presence and a strong network of partner companies.

Since 2012, we have created value for investors by acting as an efficient link between energy projects and capital. Our combination of industrial know-how and capacity to innovate ensures the necessary speed, momentum and agility in our many energy projects around the world. And by entering them at an early stage in their lifecycle, we aim to ensure a solid risk-adjusted return for our investors through our continued and diligent de-risking approach and leveraging a global partner network.